About UPS

-

-

-

Tractor Trailer Drivers | Careers at UPS Learn about a typical day-in-the-life of a UPS Tractor Trailer and Sleeper Driver. Discover more information on benefits, perks, and qualifications for the role here.

Tractor Trailer Drivers | Careers at UPS Learn about a typical day-in-the-life of a UPS Tractor Trailer and Sleeper Driver. Discover more information on benefits, perks, and qualifications for the role here. -

UNITED PARCEL SERVICE Career Path Program Promoting from within and helping UPSers build meaningful and rewarding careers is important to UPS.

UNITED PARCEL SERVICE Career Path Program Promoting from within and helping UPSers build meaningful and rewarding careers is important to UPS. -

Hourly, Part Time, Full Time and Seasonal Jobs Our hourly and seasonal employees are critical and essential. Learn more and discover hourly, part-time, full-time and seasonal jobs at UPS here.

Hourly, Part Time, Full Time and Seasonal Jobs Our hourly and seasonal employees are critical and essential. Learn more and discover hourly, part-time, full-time and seasonal jobs at UPS here. -

Military and Veteran Job Opportunities and Careers | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran Job Opportunities and Careers | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

Military and Veteran Culture | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran Culture | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

Military and Veteran Resources | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran Resources | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

Military and Veteran History | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran History | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

-

-

Explore UPS Want to learn even more about UPS? Check out these additional stories about our people, mission, values and global impact.

Explore UPS Want to learn even more about UPS? Check out these additional stories about our people, mission, values and global impact. -

-

-

In Safe Hands With the help of UPSers like Assistant Chief Pilot, Alyse Adkins, we were able to ship vaccines to more than 110 countries with a 99.9% on-time delivery rate.

In Safe Hands With the help of UPSers like Assistant Chief Pilot, Alyse Adkins, we were able to ship vaccines to more than 110 countries with a 99.9% on-time delivery rate. -

-

Christian G. "I think the main thing that separates UPS from other companies and internships is that everyone who works there—is for everyone else." Hear more from our Industrial Engineering Intern.

Christian G. "I think the main thing that separates UPS from other companies and internships is that everyone who works there—is for everyone else." Hear more from our Industrial Engineering Intern. -

Benefits for Team UPS We wouldn't be the company we are without our dedicated UPSers—which is why we offer great benefits to support their physical, financial, and emotional wellbeing.

Benefits for Team UPS We wouldn't be the company we are without our dedicated UPSers—which is why we offer great benefits to support their physical, financial, and emotional wellbeing. -

Donovan N. "Without Metro College, my life would be 10 times harder. It's a great and rewarding thing when you graduate. I would do it all over again like I just did." Hear from our Procurement Coordinator.

Donovan N. "Without Metro College, my life would be 10 times harder. It's a great and rewarding thing when you graduate. I would do it all over again like I just did." Hear from our Procurement Coordinator. -

Alexandra O. "Je suis à ma place ici. J’ai un but ici." Écoutez davantage notre superviseure sur route et découvrez son parcours ici chez UPS.

Alexandra O. "Je suis à ma place ici. J’ai un but ici." Écoutez davantage notre superviseure sur route et découvrez son parcours ici chez UPS. -

Anette B. "At UPS, I feel included because we are involved in decision making as a team and our opinions matter." Hear more from our Billing Coordinator.

Anette B. "At UPS, I feel included because we are involved in decision making as a team and our opinions matter." Hear more from our Billing Coordinator. -

Anlly M. "I'm proud to know that we connect the world and that, here, we can be who we are. Even with a dress code, we can express ourselves." Hear more from our Accounts Payable Supervisor.

Anlly M. "I'm proud to know that we connect the world and that, here, we can be who we are. Even with a dress code, we can express ourselves." Hear more from our Accounts Payable Supervisor. -

-

-

-

-

-

-

-

-

-

-

Anlly M. "Estoy orgullosa de saber que conectamos el mundo y que, aquí, podemos ser quienes somos. Incluso con un código de vestimenta, podemos expresarnos." Hear more from our Accounts Payable Supervisor.

Anlly M. "Estoy orgullosa de saber que conectamos el mundo y que, aquí, podemos ser quienes somos. Incluso con un código de vestimenta, podemos expresarnos." Hear more from our Accounts Payable Supervisor. -

Anthony V. "I’ve learned a lot about military culture and how veterans transition to the workplace, which is something I would have never known." Hear more from our Human Resources Intern.

Anthony V. "I’ve learned a lot about military culture and how veterans transition to the workplace, which is something I would have never known." Hear more from our Human Resources Intern. -

Arnold S. "Here, I feel comfortable in my own skin." Hear more from our Customer Service team member, Arnold, about his experience working in our welcoming culture.

Arnold S. "Here, I feel comfortable in my own skin." Hear more from our Customer Service team member, Arnold, about his experience working in our welcoming culture. -

Carina C "I like that our growth can be lateral or vertical—it's our call. I get to decide how I want to grow and what I want to experience." Hear more from our Operations Excellence Staff Manager.

Carina C "I like that our growth can be lateral or vertical—it's our call. I get to decide how I want to grow and what I want to experience." Hear more from our Operations Excellence Staff Manager. -

Learn About Metropolitan College Interested in growing your education with the help of UPS? Start here—with all the information you need to know about the Metropolitan College Education Program.

Learn About Metropolitan College Interested in growing your education with the help of UPS? Start here—with all the information you need to know about the Metropolitan College Education Program. -

-

-

-

-

-

Discover UPS Airline Our air fleet is fully equipped to deliver what matters across the world. On this team, you’ll get to see firsthand the logistics that support UPS Air Cargo and make our global operations possible.

Discover UPS Airline Our air fleet is fully equipped to deliver what matters across the world. On this team, you’ll get to see firsthand the logistics that support UPS Air Cargo and make our global operations possible. -

Shawna B. "Metro College gives students a leg up because they already have an employer who is investing in them." Here from a Metropolitan College Alum.

Shawna B. "Metro College gives students a leg up because they already have an employer who is investing in them." Here from a Metropolitan College Alum. -

Discover UPS Engineering There’s a UPS team for most engineering specialties—including electrical, civil, and mechanical. You’ll get to work on key projects like automation, facility maintenance, conveyor design, and more!

Discover UPS Engineering There’s a UPS team for most engineering specialties—including electrical, civil, and mechanical. You’ll get to work on key projects like automation, facility maintenance, conveyor design, and more! -

Explore Our Sales Team Are you a problem-solver and passionate communicator? On the sales team, you can bring our services to life, identifying areas of supply chain improvement and available solutions for our customers.

Explore Our Sales Team Are you a problem-solver and passionate communicator? On the sales team, you can bring our services to life, identifying areas of supply chain improvement and available solutions for our customers. -

Bavitha B. "I would recommend the UPS summer internship program to my peers because the people I worked with made my time here very enjoyable—they were capable, motivated, and effective team players."

Bavitha B. "I would recommend the UPS summer internship program to my peers because the people I worked with made my time here very enjoyable—they were capable, motivated, and effective team players." -

Nicole G. "I had such a good experience with my supervisor and manager… never would I have thought I could learn so much in such a small timeframe." Hear from our Information Technology Intern.

Nicole G. "I had such a good experience with my supervisor and manager… never would I have thought I could learn so much in such a small timeframe." Hear from our Information Technology Intern. -

Akiva P. "We go above and beyond for our customers and provide a stellar service." Hear from our Customer Resolution Agent.

Akiva P. "We go above and beyond for our customers and provide a stellar service." Hear from our Customer Resolution Agent. -

-

-

Leah L. "I feel good when I am contributing towards something useful and positive. I feel like I am doing something great here. I love how I really am helping this company."

Leah L. "I feel good when I am contributing towards something useful and positive. I feel like I am doing something great here. I love how I really am helping this company." -

Jordan M. "Less than a year after I graduated, I bought a house on my own because of all the benefits that I received, and the freedom that I had from graduating debt free." Hear from a Metro College Alum.

Jordan M. "Less than a year after I graduated, I bought a house on my own because of all the benefits that I received, and the freedom that I had from graduating debt free." Hear from a Metro College Alum. -

Katy K. "I hope I can be a testimony to show that you can have a balance between work, school, and whatever social events or clubs you want to be a part of." Hear from a Metro College Alum.

Katy K. "I hope I can be a testimony to show that you can have a balance between work, school, and whatever social events or clubs you want to be a part of." Hear from a Metro College Alum. -

THE UPS GOLDEN RULES We all have the responsibility to promote a positive, professional work environment – for everyone. Not in Our House means we do not tolerate inappropriate behavior.

THE UPS GOLDEN RULES We all have the responsibility to promote a positive, professional work environment – for everyone. Not in Our House means we do not tolerate inappropriate behavior. -

Learn about a typical day-in-the-life of a UPS Warehouse Worker here. Review the answers to common questions about our Personal Vehicle Drivers here.

Learn about a typical day-in-the-life of a UPS Warehouse Worker here. Review the answers to common questions about our Personal Vehicle Drivers here. -

-

-

-

-

-

-

Transitional Learning Center FAQ Get all your questions answered about the UPS Transitional Learning Center program here.

Transitional Learning Center FAQ Get all your questions answered about the UPS Transitional Learning Center program here. -

School to Work FAQ Still have questions about the details of our School to Work program? You can find answers and additional information about this opportunity here.

School to Work FAQ Still have questions about the details of our School to Work program? You can find answers and additional information about this opportunity here. -

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program.

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program. -

Earn & Learn FAQ Curious about our Earn & Learn program? If you have questions, be sure to check out our FAQ page for additional information about this great UPS education option.

Earn & Learn FAQ Curious about our Earn & Learn program? If you have questions, be sure to check out our FAQ page for additional information about this great UPS education option. -

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program.

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program. -

-

-

-

Charlotte, NC Interested in checking out all of the Warehouse Worker opportunities available in this lively southern city?

Charlotte, NC Interested in checking out all of the Warehouse Worker opportunities available in this lively southern city? -

Life-saving drones This is the story of how UPS shipped blood, medicine and vaccines to facilities across Rwanda using a fleet of drones.

Life-saving drones This is the story of how UPS shipped blood, medicine and vaccines to facilities across Rwanda using a fleet of drones. -

Giving back to those who gave so much UPS is a long-time supporter of veterans. This is just one story of how our employees have gotten involved with initiatives that give back to those who’ve given so much to our country.

Giving back to those who gave so much UPS is a long-time supporter of veterans. This is just one story of how our employees have gotten involved with initiatives that give back to those who’ve given so much to our country. -

FlightPath I Interested in flying with UPS? Check out this immersive program where you can take your first steps. Available to recent grads and current juniors or seniors!

FlightPath I Interested in flying with UPS? Check out this immersive program where you can take your first steps. Available to recent grads and current juniors or seniors! -

FlightPath II This 36-month program helps you achieve the required benchmarks needed to interview with UPS Airlines. You'll develop skills, build experience, and receive expert mentoring.

FlightPath II This 36-month program helps you achieve the required benchmarks needed to interview with UPS Airlines. You'll develop skills, build experience, and receive expert mentoring. -

FlightPath Overview Ready to take your career to new heights? Become a pilot with UPS. You'll fly with one of the world’s largest and safest airlines while helping move the world forward by delivering what matters.

FlightPath Overview Ready to take your career to new heights? Become a pilot with UPS. You'll fly with one of the world’s largest and safest airlines while helping move the world forward by delivering what matters. -

Puestos por hora Ayudarás a entregar lo que importa. Ofrecemos puestos por hora de tiempo completo, medio tiempo, durante todo el año y por temporada.

Puestos por hora Ayudarás a entregar lo que importa. Ofrecemos puestos por hora de tiempo completo, medio tiempo, durante todo el año y por temporada. -

Erin M. "L’avis de tous est important; c’est pourquoi nous avons une politique de la porte ouverte. Si vous avez des idées et que vous souhaitez en parler, n’hésitez pas!"

Erin M. "L’avis de tous est important; c’est pourquoi nous avons une politique de la porte ouverte. Si vous avez des idées et que vous souhaitez en parler, n’hésitez pas!" -

Evan B. "Never stop asking questions, because that’s really how you’ll learn." Hear about our Engineering Intern and his educational experience here at UPS.

Evan B. "Never stop asking questions, because that’s really how you’ll learn." Hear about our Engineering Intern and his educational experience here at UPS. -

Spring Y. "My well-being is a priority here and not an afterthought." Hear more from our Operations Supervisor of Contracts Logistics.

Spring Y. "My well-being is a priority here and not an afterthought." Hear more from our Operations Supervisor of Contracts Logistics. -

Sydnee A. "At the end of the day I love knowing that people have been with UPS for a long time and they rise and grow." Hear more from our Human Resources Intern.

Sydnee A. "At the end of the day I love knowing that people have been with UPS for a long time and they rise and grow." Hear more from our Human Resources Intern. -

Bayonne, NJ See what's happening at our New Jersey facility and join our team of Warehouse Workers to help us deliver what matters.

Bayonne, NJ See what's happening at our New Jersey facility and join our team of Warehouse Workers to help us deliver what matters. -

Atlanta, GA Curious to see what UPS operations are like in Georgia's capital city? Check out opportunities at our Atlanta hub.

Atlanta, GA Curious to see what UPS operations are like in Georgia's capital city? Check out opportunities at our Atlanta hub. -

Greenville, SC This pedestrian-friendly city is home to art, outdoor, and—of course—our UPS warehouse. Apply today to join our team here.

Greenville, SC This pedestrian-friendly city is home to art, outdoor, and—of course—our UPS warehouse. Apply today to join our team here. -

San Antonio, TX Find opportunities at UPS warehouse facilities here in Texas—where you'll also be able to enjoy a rich, vibrant culture.

San Antonio, TX Find opportunities at UPS warehouse facilities here in Texas—where you'll also be able to enjoy a rich, vibrant culture. -

DFW, TX Become part of Team UPS here in Dallas-Fort Worth, Texas! We're now hiring for Warehouse Worker roles.

DFW, TX Become part of Team UPS here in Dallas-Fort Worth, Texas! We're now hiring for Warehouse Worker roles. -

Mebane, NC Our warehouse workers thrive in a fast-paced environment—even during night shifts! Apply to join Team UPS today.

Mebane, NC Our warehouse workers thrive in a fast-paced environment—even during night shifts! Apply to join Team UPS today. -

UPS SMART Hub Discover opportunities to join UPS at this impressive facility in Atlanta, Georgia. With advancement and automation throughout the SMART hub, you’ll get to see our industry-leading technology at work.

UPS SMART Hub Discover opportunities to join UPS at this impressive facility in Atlanta, Georgia. With advancement and automation throughout the SMART hub, you’ll get to see our industry-leading technology at work. -

Los Angeles, CA Ready to start a career with UPS in sunny LA? Check out what it takes to become a Warehouse Worker in our hub.

Los Angeles, CA Ready to start a career with UPS in sunny LA? Check out what it takes to become a Warehouse Worker in our hub. -

Madison, WI We're now hiring in the Madison area! Check out available opportunities near this ideally located city.

Madison, WI We're now hiring in the Madison area! Check out available opportunities near this ideally located city. -

Nashville, TN Discover new opportunities near Music City! We're now hiring Warehouse Workers at our nearby hub.

Nashville, TN Discover new opportunities near Music City! We're now hiring Warehouse Workers at our nearby hub. -

New York, NY Discover our UPS operations in the greater New York area. We're now hiring for Warehouse Workers in various shifts!

New York, NY Discover our UPS operations in the greater New York area. We're now hiring for Warehouse Workers in various shifts! -

Middletown, PA This impressive new facility is now up and running in Pennsylvania! We're hiring new team members to support operations.

Middletown, PA This impressive new facility is now up and running in Pennsylvania! We're hiring new team members to support operations. -

Naples, FL Join us in Naples, FL today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

Naples, FL Join us in Naples, FL today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits. -

Portland, OR Ready to join Team UPS? Discover new opportunities at our warehouse located in Oregon's largest city.

Portland, OR Ready to join Team UPS? Discover new opportunities at our warehouse located in Oregon's largest city. -

Shelly C. "From day one, I loved the open-door culture and it’s still great more than 10 years later." Hear more from our Marketing Pricing Manager.

Shelly C. "From day one, I loved the open-door culture and it’s still great more than 10 years later." Hear more from our Marketing Pricing Manager. -

Sherry S. "My career here, 20 years and counting, is a story of progress and moving forward." Hear more form our International Director of Freight.

Sherry S. "My career here, 20 years and counting, is a story of progress and moving forward." Hear more form our International Director of Freight. -

Zane P. "The trust that my team has in me speaks volumes about the company. It gives me the chance to show my abilities and come up with something great." Hear more from our DE&I Intern.

Zane P. "The trust that my team has in me speaks volumes about the company. It gives me the chance to show my abilities and come up with something great." Hear more from our DE&I Intern. -

Reginaldo T. "Entregar o que importa é o que me faz feliz. Trazer a vacina da COVID para o Brasil me deixou muito orgulhoso, saber que participei deste momento confirma que entregamos o que importa."

Reginaldo T. "Entregar o que importa é o que me faz feliz. Trazer a vacina da COVID para o Brasil me deixou muito orgulhoso, saber que participei deste momento confirma que entregamos o que importa." -

Savannah V. "This program has given me so many opportunities to figure out exactly what I want to do and find myself." Hear from a Metropolitan College Alum.

Savannah V. "This program has given me so many opportunities to figure out exactly what I want to do and find myself." Hear from a Metropolitan College Alum. -

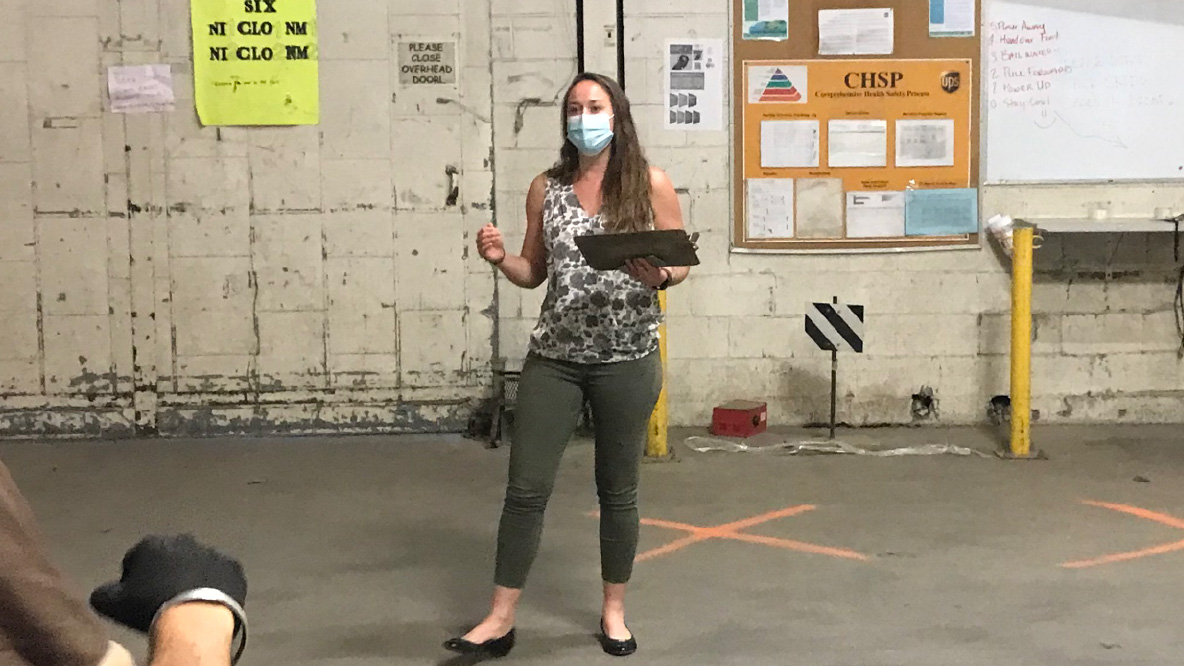

Sharlene F. "I appreciate that UPS delivers what matters in terms of the business, but also in terms of the people." Hear more from our Local Sort Supervisor.

Sharlene F. "I appreciate that UPS delivers what matters in terms of the business, but also in terms of the people." Hear more from our Local Sort Supervisor. -

Sharlene F. "J’apprécie le fait qu’UPS livre l’essentiel non seulement sur le plan des affaires, mais aussi sur le plan humain."

Sharlene F. "J’apprécie le fait qu’UPS livre l’essentiel non seulement sur le plan des affaires, mais aussi sur le plan humain." -

Sheneda W. "I definitely will recommend this program to my friends…before, I was in companies where I just got coffee, now I’m getting hands on experience and I love the team I’m on."

Sheneda W. "I definitely will recommend this program to my friends…before, I was in companies where I just got coffee, now I’m getting hands on experience and I love the team I’m on." -

Kevin L. "I was really able to gain a lot of insights into how what I do in the tech world impacts the business side of things." Hear from our Information Technology Intern.

Kevin L. "I was really able to gain a lot of insights into how what I do in the tech world impacts the business side of things." Hear from our Information Technology Intern. -

Laura R. "Some people think that we delivery packages but it is more than that, here we deliver dreams, gifts, memories." Hear more from our Procurement Supervisor.

Laura R. "Some people think that we delivery packages but it is more than that, here we deliver dreams, gifts, memories." Hear more from our Procurement Supervisor. -

Laura R. "Algunos piensan que entregamos paquetes pero es más que eso, aquí entregamos sueños, regalos, recuerdos".

Laura R. "Algunos piensan que entregamos paquetes pero es más que eso, aquí entregamos sueños, regalos, recuerdos". -

Lillian Z. "I definitely enjoy the communication aspects the most. I'm able to bring new ideas and actually be listened to." Hear more from our Intern at UPS Capital.

Lillian Z. "I definitely enjoy the communication aspects the most. I'm able to bring new ideas and actually be listened to." Hear more from our Intern at UPS Capital. -

Rising In the Face of Disaster This is the story of how UPS has shipped army hospitals overnight across the US—from Reno, Nevada, to New Orleans, Louisiana.

Rising In the Face of Disaster This is the story of how UPS has shipped army hospitals overnight across the US—from Reno, Nevada, to New Orleans, Louisiana. -

St. Louis, MO Join Team UPS at one of our Missouri-based facilities and deliver what matters across the Midwest and beyond.

St. Louis, MO Join Team UPS at one of our Missouri-based facilities and deliver what matters across the Midwest and beyond. -

Earth City, MO Join UPS just outside of St. Louis! As a Warehouse Worker, you'll be helping us deliver what matters every day.

Earth City, MO Join UPS just outside of St. Louis! As a Warehouse Worker, you'll be helping us deliver what matters every day. -

Indianapolis, IN Now hiring! Explore new opportunities to work for UPS as a Warehouse Worker out of our incredible Indy facilities.

Indianapolis, IN Now hiring! Explore new opportunities to work for UPS as a Warehouse Worker out of our incredible Indy facilities. -

Oakland, CA Want to help deliver what matters in the Bay Area? Find available roles at our nearby UPS facility.

Oakland, CA Want to help deliver what matters in the Bay Area? Find available roles at our nearby UPS facility. -

UPS Worldport Get to know more about the biggest UPS hub in the world—also known as UPS Worldport—located right here in Louisville!

UPS Worldport Get to know more about the biggest UPS hub in the world—also known as UPS Worldport—located right here in Louisville! -

Carlos P. "¡Puedo decir que me enamoré de ser un UPSer! Acá ayudamos a nuestras comunidades y a las empresas a crecer; ayudamos a abrir puertas al entregar soluciones logísticas diferentes y crecemos juntos."

Carlos P. "¡Puedo decir que me enamoré de ser un UPSer! Acá ayudamos a nuestras comunidades y a las empresas a crecer; ayudamos a abrir puertas al entregar soluciones logísticas diferentes y crecemos juntos." -

Oby A. "I joined UPS right after college and have been here for 25 years. It's been UPS all the way for me." Hear more from our Brokerage Supervisor.

Oby A. "I joined UPS right after college and have been here for 25 years. It's been UPS all the way for me." Hear more from our Brokerage Supervisor. -

Daniel N. "I think what really helps is being able to show that you have your own voice within your team and also being able to explore outside of your team." Hear more from our Procurement Intern.

Daniel N. "I think what really helps is being able to show that you have your own voice within your team and also being able to explore outside of your team." Hear more from our Procurement Intern. -

Doreen D. "I have high expectations of myself. UPS builds me up to exceed them again and again." Hear more from the Manager of our Customer Service team.

Doreen D. "I have high expectations of myself. UPS builds me up to exceed them again and again." Hear more from the Manager of our Customer Service team. -

Elena X. "If you have the drive to grow and develop yourself, this is where you’d want to be." Hear more about our Account Payable Manager and her journey here at UPS.

Elena X. "If you have the drive to grow and develop yourself, this is where you’d want to be." Hear more about our Account Payable Manager and her journey here at UPS. -

Erin M. "Everybody's voice matters and we have an open-door policy. So if you've got ideas and want to talk about them, let's do it!" Hear more from our Lead Project Coordination Analyst.

Erin M. "Everybody's voice matters and we have an open-door policy. So if you've got ideas and want to talk about them, let's do it!" Hear more from our Lead Project Coordination Analyst. -

Alexandra O. "I'm meant to be here. I have a purpose here." Hear more from our On-Road Supervisor and learn about her journey here at UPS.

Alexandra O. "I'm meant to be here. I have a purpose here." Hear more from our On-Road Supervisor and learn about her journey here at UPS. -

Carlos P. "I can say that I fell in love with being a UPSer! Here we help societies and companies to grow; we help to open doors by delivering different logistics solutions and we grow together."

Carlos P. "I can say that I fell in love with being a UPSer! Here we help societies and companies to grow; we help to open doors by delivering different logistics solutions and we grow together." -

Firdous Q. "UPS has an open work culture and a supportive team working together to achieve a common goal." Hear from our Legal Analyst in the Legal and Secretarial Department.

Firdous Q. "UPS has an open work culture and a supportive team working together to achieve a common goal." Hear from our Legal Analyst in the Legal and Secretarial Department. -

Itz-El M. "At UPS you are able to change and develop not only your professional skills but also your personal ones." Hear more from our Industrial Engineering Manager.

Itz-El M. "At UPS you are able to change and develop not only your professional skills but also your personal ones." Hear more from our Industrial Engineering Manager. -

Join IT at UPS Our trusted technology experts to keep everything running smoothly at UPS. From data analytics to web development and much more, UPS leads innovation within the delivery and logistics industry.

Join IT at UPS Our trusted technology experts to keep everything running smoothly at UPS. From data analytics to web development and much more, UPS leads innovation within the delivery and logistics industry. -

Spreading Cheer to Those in Need The holidays always bring global excitement—and our hardworking UPSers work around the clock to make the season extra special. We consider it an honor to deliver these important packages.

Spreading Cheer to Those in Need The holidays always bring global excitement—and our hardworking UPSers work around the clock to make the season extra special. We consider it an honor to deliver these important packages. -

Ariel B. "UPS really values and treats everyone equally. There are opportunities for everyone no matter what job you’re doing, what role you’re coming from, where you’re coming from, your background, etc."

Ariel B. "UPS really values and treats everyone equally. There are opportunities for everyone no matter what job you’re doing, what role you’re coming from, where you’re coming from, your background, etc." -

Rhea B. "UPS is a place where I can be myself, it's why I've gotten to where I am today." Hear more form our Human Resources Systems Supervisor.

Rhea B. "UPS is a place where I can be myself, it's why I've gotten to where I am today." Hear more form our Human Resources Systems Supervisor. -

Katie T. "I like that I can be sitting in my cubicle and someone that I’ve never spoken to before can just knock and strike up a conversation with me." Hear more from our Procurement Intern.

Katie T. "I like that I can be sitting in my cubicle and someone that I’ve never spoken to before can just knock and strike up a conversation with me." Hear more from our Procurement Intern. -

Lauren S. "What I enjoy most about UPS’s company culture is the willingness of everyone at the company to help you in any way to grow." Hear more from our Recruitment Marketing Intern.

Lauren S. "What I enjoy most about UPS’s company culture is the willingness of everyone at the company to help you in any way to grow." Hear more from our Recruitment Marketing Intern. -

The Gift of Life, Delivered UPS is trusted to ship life-saving organs to transplant centers across the US thanks to our express critical healthcare services.

The Gift of Life, Delivered UPS is trusted to ship life-saving organs to transplant centers across the US thanks to our express critical healthcare services. -

Caring About Our Local Community Wherever we work, we help. Wherever our employees live and customers are, we help. Wherever and whenever we can, we help. And we do it through volunteerism and providing resources.

Caring About Our Local Community Wherever we work, we help. Wherever our employees live and customers are, we help. Wherever and whenever we can, we help. And we do it through volunteerism and providing resources. -

Itz-el M. En UPS eres capaz de cambiar y desarrollar no sólo tus habilidades profesionales, sino que las personales también.

Itz-el M. En UPS eres capaz de cambiar y desarrollar no sólo tus habilidades profesionales, sino que las personales también. -

Jairo R. “Here at UPS we have daily challenges and opportunities for growth with the company. What I like here is that we can always improve. I can be who I am - in and out of UPS.”

Jairo R. “Here at UPS we have daily challenges and opportunities for growth with the company. What I like here is that we can always improve. I can be who I am - in and out of UPS.” -

Jairo R. "Aquí en UPS tenemos retos diarios y oportunidades de crecimiento con la empresa. Lo que me gusta aquí es que siempre podemos mejorar. Puedo ser quien soy—dentro y fuera de UPS".

Jairo R. "Aquí en UPS tenemos retos diarios y oportunidades de crecimiento con la empresa. Lo que me gusta aquí es que siempre podemos mejorar. Puedo ser quien soy—dentro y fuera de UPS". -

Ousseynou G. "This Could Be 'U'PS" Hear all about this Telecommunication Analyst's journey from intern to full-time UPSer—and what his advice is for the next generation of Team UPS.

Ousseynou G. "This Could Be 'U'PS" Hear all about this Telecommunication Analyst's journey from intern to full-time UPSer—and what his advice is for the next generation of Team UPS. -

Pam M. "I believe in what UPS does for the wider community and am proud to be a part of it." Hear more from our Employee Development Assistant.

Pam M. "I believe in what UPS does for the wider community and am proud to be a part of it." Hear more from our Employee Development Assistant. -

Pam M. "Je crois en ce qu’UPS fait pour l’ensemble de la collectivité et je suis fière d’y contribuer."

Pam M. "Je crois en ce qu’UPS fait pour l’ensemble de la collectivité et je suis fière d’y contribuer." -

Portia M. "I've always felt that I belonged to UPS since day one." Hear more about our Human Resources Geo Services Manager and her journey with us.

Portia M. "I've always felt that I belonged to UPS since day one." Hear more about our Human Resources Geo Services Manager and her journey with us. -

Pranali C. "UPS gives me the autonomy to work with a touch of my style—even in a legal role." Hear how our Legal Analyst brings her personality to work each day.

Pranali C. "UPS gives me the autonomy to work with a touch of my style—even in a legal role." Hear how our Legal Analyst brings her personality to work each day. -

Reginaldo T. "Delivering what matters is what makes me happy. Bringing COVID's vaccine to Brazil made me very proud, knowing that I participated in this moment confirms that we do deliver what matters."

Reginaldo T. "Delivering what matters is what makes me happy. Bringing COVID's vaccine to Brazil made me very proud, knowing that I participated in this moment confirms that we do deliver what matters." -

Jake P. "Here at UPS, they actually use your projects and you’re doing meaningful work. I think that’s huge just because it gives you actual insight into what the real world is like."

Jake P. "Here at UPS, they actually use your projects and you’re doing meaningful work. I think that’s huge just because it gives you actual insight into what the real world is like." -

Jocelyn S. "UPS is a family to me. They treat me as family member and not an employee." Hear more from our Customer Service Agent about the culture here at UPS.

Jocelyn S. "UPS is a family to me. They treat me as family member and not an employee." Hear more from our Customer Service Agent about the culture here at UPS. -

Kamshat M. "I come to work every day with a spirit to learn, solve issues, and develop my interpersonal skills." Hear more from our award-winning Country Manager.

Kamshat M. "I come to work every day with a spirit to learn, solve issues, and develop my interpersonal skills." Hear more from our award-winning Country Manager. -

Making Progress Toward Our Sustainability and Social Impact Goals Our Sustainability and Social Impact Report shows how we're delivering for our customers, our people, our communities and our planet. Check out the key takeaways from our 2023 report.

Making Progress Toward Our Sustainability and Social Impact Goals Our Sustainability and Social Impact Report shows how we're delivering for our customers, our people, our communities and our planet. Check out the key takeaways from our 2023 report. -

Helping Build a Better World We’re delivering what matters to our customers, our people, our communities and our planet.

Helping Build a Better World We’re delivering what matters to our customers, our people, our communities and our planet. -

What Do You Do for a Living? UPS driver answers social media star’s famous question

What Do You Do for a Living? UPS driver answers social media star’s famous question -

Boston, MA This incredible northeastern city is the perfect place to join the UPS team as a Warehouse Worker.

Boston, MA This incredible northeastern city is the perfect place to join the UPS team as a Warehouse Worker. -

Burlington, VT Discover a great career with UPS in this stunning lakefront city. Now hiring for various positions and shifts in Vermont.

Burlington, VT Discover a great career with UPS in this stunning lakefront city. Now hiring for various positions and shifts in Vermont. -

Chicago, IL Interested in joining Team UPS? See what it takes to be part of the facility that's serving the greater Chicagoland area.

Chicago, IL Interested in joining Team UPS? See what it takes to be part of the facility that's serving the greater Chicagoland area. -

Cincinnati, OH Discover opportunities to join the dedicated team of UPSers working out of one of Ohio's great cities.

Cincinnati, OH Discover opportunities to join the dedicated team of UPSers working out of one of Ohio's great cities. -

Salt Lake City, UT Home to stunning mountains, exciting winter sports, and a state-of-the-art UPS hub. Explore opportunities to join our team today.

Salt Lake City, UT Home to stunning mountains, exciting winter sports, and a state-of-the-art UPS hub. Explore opportunities to join our team today. -

Pittsburgh, PA Come join UPS at our warehouse facility serving the greater Pittsburgh area. Currently hiring for a range of shifts.

Pittsburgh, PA Come join UPS at our warehouse facility serving the greater Pittsburgh area. Currently hiring for a range of shifts. -

Allentown, PA Come join UPS at our impressive Allentown facility. Now hiring for various positions and shifts—apply online today.

Allentown, PA Come join UPS at our impressive Allentown facility. Now hiring for various positions and shifts—apply online today. -

Denver, CO Experience UPS in the Mile High City. We're now hiring Warehouse Workers for various shifts in our local facility.

Denver, CO Experience UPS in the Mile High City. We're now hiring Warehouse Workers for various shifts in our local facility. -

Harrisburg, PA Ready to join Team UPS? Explore the Warehouse Worker jobs that we're currently hiring for near this stunning capital city.

Harrisburg, PA Ready to join Team UPS? Explore the Warehouse Worker jobs that we're currently hiring for near this stunning capital city. -

North Baltimore, OH There's no better place to join Team UPS than at this impressive, newly opened Ohio facility. Apply online today.

North Baltimore, OH There's no better place to join Team UPS than at this impressive, newly opened Ohio facility. Apply online today. -

Ontario, CA Come join Team UPS to help deliver what matters at one of our busiest facilities in the state of California.

Ontario, CA Come join Team UPS to help deliver what matters at one of our busiest facilities in the state of California. -

Kansas City, MO Find opportunities to join the UPS hub that sits at the heart of the US in this exciting Midwest city. Apply online today.

Kansas City, MO Find opportunities to join the UPS hub that sits at the heart of the US in this exciting Midwest city. Apply online today. -

Philadelphia, PA Discover new opportunities in Philly at our nearby UPS hub. Now hiring for Warehouse Worker positions.

Philadelphia, PA Discover new opportunities in Philly at our nearby UPS hub. Now hiring for Warehouse Worker positions. -

Minneapolis, MN Find new opportunities to join UPS working out of our warehouse facility in one of the Twin Cities.

Minneapolis, MN Find new opportunities to join UPS working out of our warehouse facility in one of the Twin Cities. -

Phoenix, AZ Our incredible warehouse facilities are less than 10 miles from downtown Phoenix. Apply today to join Team UPS in Arizona.

Phoenix, AZ Our incredible warehouse facilities are less than 10 miles from downtown Phoenix. Apply today to join Team UPS in Arizona. -

Rockford, IL Now hiring for Warehouse Workers across various shifts. Discover what makes this Illinois hub a great place to join Team UPS.

Rockford, IL Now hiring for Warehouse Workers across various shifts. Discover what makes this Illinois hub a great place to join Team UPS. -

Louisville, KY Discover opportunities to join Team UPS working out of our massive Worldport facility—one of the busiest global UPS hubs.

Louisville, KY Discover opportunities to join Team UPS working out of our massive Worldport facility—one of the busiest global UPS hubs. -

Seattle, WA Join Team UPS in the Pacific Northwest region. Our Washington-area facilities are growing—so apply today.

Seattle, WA Join Team UPS in the Pacific Northwest region. Our Washington-area facilities are growing—so apply today. -

Syracuse, NY Come join Team UPS from our regional facility in central New York. See which roles we're currently hiring for.

Syracuse, NY Come join Team UPS from our regional facility in central New York. See which roles we're currently hiring for. -

UPS Careers in Carlsbad, CA UPS offers opportunities all over the country—and the world! Right now we are looking to fill in the openings for our new location in Carlsbad, CA.

UPS Careers in Carlsbad, CA UPS offers opportunities all over the country—and the world! Right now we are looking to fill in the openings for our new location in Carlsbad, CA. -

Laura C. “I crave change that challenges me. That’s what keeps me here for 21 years and counting.” Hear from our Business Manager of Small Package Operations.

Laura C. “I crave change that challenges me. That’s what keeps me here for 21 years and counting.” Hear from our Business Manager of Small Package Operations. -

Washington, DC Join Team UPS in our nation's capital! We're hiring new team members to support regional operations and help deliver what matters.

Washington, DC Join Team UPS in our nation's capital! We're hiring new team members to support regional operations and help deliver what matters. -

Ryan R. "I would definitely recommend this internship for students looking to get technical skills or to apply what they have learned in their classes." Hear from our Information Technology Intern.

Ryan R. "I would definitely recommend this internship for students looking to get technical skills or to apply what they have learned in their classes." Hear from our Information Technology Intern. -

Seasonal Support Driver UPSer Brenda explains what she loves about delivering packages from her own car as a Seasonal Support Driver. Watch Video (Video, Opens in Popup)

Seasonal Support Driver UPSer Brenda explains what she loves about delivering packages from her own car as a Seasonal Support Driver. Watch Video (Video, Opens in Popup) -

Trailblazing Twin Sisters Alyssa Strickland and Brittney Strickland-Varnedoe are identical twins and colleagues who have become an inspiration for other women in operations. Read more about the important work they’re doing as On-Road Supervisors to keep our tractor-trailer drivers safe.

Trailblazing Twin Sisters Alyssa Strickland and Brittney Strickland-Varnedoe are identical twins and colleagues who have become an inspiration for other women in operations. Read more about the important work they’re doing as On-Road Supervisors to keep our tractor-trailer drivers safe. -

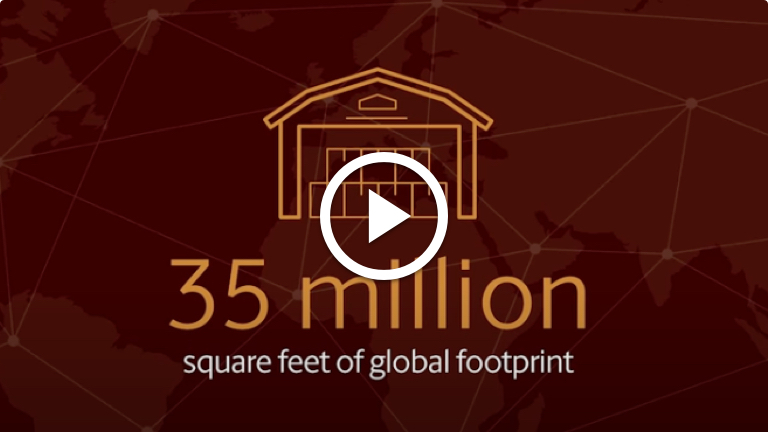

UPS Logistics & Distribution - Where Business Takes Shape Every day, our team directs a global network of movement. See what it takes to keep our world in motion. Watch Video (Video, Opens in Popup)

UPS Logistics & Distribution - Where Business Takes Shape Every day, our team directs a global network of movement. See what it takes to keep our world in motion. Watch Video (Video, Opens in Popup) -

UPS Business Development Learn about our exciting Business Development opportunities. UPS provides great training and support to make sure you are successful in the role. Watch Video (Video, Opens in Popup)

UPS Business Development Learn about our exciting Business Development opportunities. UPS provides great training and support to make sure you are successful in the role. Watch Video (Video, Opens in Popup) -

UPS Healthcare Hear about UPS Healthcare's capabilities- the future of healthcare is being built right now, and UPS Healthcare is helping to shape it. Watch Video (Video, Opens in Popup)

UPS Healthcare Hear about UPS Healthcare's capabilities- the future of healthcare is being built right now, and UPS Healthcare is helping to shape it. Watch Video (Video, Opens in Popup) -

Enhanced Global Operations in Hong Kong Learn about our recent agreement with the Hong Kong Airport Authority and how we’ll expanding our reach in the Asia Pacific market.

Enhanced Global Operations in Hong Kong Learn about our recent agreement with the Hong Kong Airport Authority and how we’ll expanding our reach in the Asia Pacific market. -

UPS Healthcare in Louisville Hear from Rebekah Gant, a Louisville Warehouse Associate, on the impact of playing a role in the shipping of over 500 million test COVID-19 kits. Watch Video (Video, Opens in Popup)

UPS Healthcare in Louisville Hear from Rebekah Gant, a Louisville Warehouse Associate, on the impact of playing a role in the shipping of over 500 million test COVID-19 kits. Watch Video (Video, Opens in Popup) -

Our Modular Hubs Hear from Jimmy Paola, UPS Project Manager, as he walks us through the construction of the Nashua Modular Hub. Watch Video (Video, Opens in Popup)

Our Modular Hubs Hear from Jimmy Paola, UPS Project Manager, as he walks us through the construction of the Nashua Modular Hub. Watch Video (Video, Opens in Popup) -

UPS Inside Sales Hear from two of our Inside Sales Representatives on how they got started with UPS and how they are helping others develop their careers. Watch Video (Video, Opens in Popup)

UPS Inside Sales Hear from two of our Inside Sales Representatives on how they got started with UPS and how they are helping others develop their careers. Watch Video (Video, Opens in Popup) -

UPS Premier Learn about our Technology Enabled Network for Healthcare shipments, helping to deliver hope. Watch Video (Video, Opens in Popup)

UPS Premier Learn about our Technology Enabled Network for Healthcare shipments, helping to deliver hope. Watch Video (Video, Opens in Popup) -

Introducing AI at UPS Velocity Facility We’re keeping our operations on the cutting-edge by using artificial intelligence to supplement our dedicated team—for 30% storage optimization! Watch Video (Video, Opens in Popup)

Introducing AI at UPS Velocity Facility We’re keeping our operations on the cutting-edge by using artificial intelligence to supplement our dedicated team—for 30% storage optimization! Watch Video (Video, Opens in Popup) -

UPS Account Executives Tanner Trevino, Account Executive, shares how he started in Inside Sales and has grown within our Business Development team. Watch Video (Video, Opens in Popup)

UPS Account Executives Tanner Trevino, Account Executive, shares how he started in Inside Sales and has grown within our Business Development team. Watch Video (Video, Opens in Popup) -

Sounds Like Opportunity The world of a UPS warehouse is like nowhere else. Step inside to see - and hear - what it's all about. Watch Video (Video, Opens in Popup)

Sounds Like Opportunity The world of a UPS warehouse is like nowhere else. Step inside to see - and hear - what it's all about. Watch Video (Video, Opens in Popup) -

Our Purpose Our purpose is not just what we do, more importantly, it’s why we do it. It’s the reason we get up in the morning. It’s the motivation that guides how we choose to spend our day. Simply put, it’s the reason we are here. Watch Video (Video, Opens in Popup)

Our Purpose Our purpose is not just what we do, more importantly, it’s why we do it. It’s the reason we get up in the morning. It’s the motivation that guides how we choose to spend our day. Simply put, it’s the reason we are here. Watch Video (Video, Opens in Popup) -

Fleet Fitness Discover how Olivia, a Feeder Driver in Idaho, takes her passion for fitness on the road. Watch Video (Video, Opens in Popup)

Fleet Fitness Discover how Olivia, a Feeder Driver in Idaho, takes her passion for fitness on the road. Watch Video (Video, Opens in Popup) -

Tractor Trailer Driver Tom Hear from Tom, a Tractor Trailer Driver at UPS, about what he loves about the job. Watch Video (Video, Opens in Popup)

Tractor Trailer Driver Tom Hear from Tom, a Tractor Trailer Driver at UPS, about what he loves about the job. Watch Video (Video, Opens in Popup) -

Shift Your Career Whatever your skills and wherever you want your work to take you, you could find what you're looking for at UPS. Watch Video (Video, Opens in Popup)

Shift Your Career Whatever your skills and wherever you want your work to take you, you could find what you're looking for at UPS. Watch Video (Video, Opens in Popup) -

Bring Your Skills to UPS At UPS, you can contribute to industry innovation, work with cutting-edge tech, and access all of the resources you would expect from a globally recognized brand. Watch Video (Video, Opens in Popup)

Bring Your Skills to UPS At UPS, you can contribute to industry innovation, work with cutting-edge tech, and access all of the resources you would expect from a globally recognized brand. Watch Video (Video, Opens in Popup) -

Nashua Modular Hub While most of our engineering partners help maintain buildings that are already built, here is a glimpse of how our Engineers construct innovative new buildings. Watch Video (Video, Opens in Popup)

Nashua Modular Hub While most of our engineering partners help maintain buildings that are already built, here is a glimpse of how our Engineers construct innovative new buildings. Watch Video (Video, Opens in Popup) -

UPS Hype Man When UPSers enter the gates at the Independence Hub in Fort Worth, Texas, they are greeted by the sound of music and cheers from fellow UPSer Darrell Hayward. Darrell has a passion to get his fellow UPS coworkers smiling. Watch Video (Video, Opens in Popup)

UPS Hype Man When UPSers enter the gates at the Independence Hub in Fort Worth, Texas, they are greeted by the sound of music and cheers from fellow UPSer Darrell Hayward. Darrell has a passion to get his fellow UPS coworkers smiling. Watch Video (Video, Opens in Popup) -

UPS Global Logistics & Distribution See how we work with our customers and as an organization to be better together, providing retail and e-commerce fulfillment solutions for companies of all sizes. Watch Video (Video, Opens in Popup)

UPS Global Logistics & Distribution See how we work with our customers and as an organization to be better together, providing retail and e-commerce fulfillment solutions for companies of all sizes. Watch Video (Video, Opens in Popup) -

UPS Plant Engineering Hear from Mike about what it means to work in Plant Engineering at UPS. Watch Video (Video, Opens in Popup)

UPS Plant Engineering Hear from Mike about what it means to work in Plant Engineering at UPS. Watch Video (Video, Opens in Popup) -

Our Driver Helpers Hear from real Driver Helpers on why they are essential to the team at UPS. Watch Video (Video, Opens in Popup)

Our Driver Helpers Hear from real Driver Helpers on why they are essential to the team at UPS. Watch Video (Video, Opens in Popup) -

VR Driver Safety Training Our virtual reality headsets vividly simulate the experience of driving on city streets while teaching a more memorable classroom lesson. Watch Video (Video, Opens in Popup)

VR Driver Safety Training Our virtual reality headsets vividly simulate the experience of driving on city streets while teaching a more memorable classroom lesson. Watch Video (Video, Opens in Popup) -

UPSer Story: Tammy UPS Package Delivery Drivers can build remarkable bonds with the communities they serve. This is the story of 6-year-old Parson and her favorite UPS Driver, Miss Tammy. Watch Video (Video, Opens in Popup)

UPSer Story: Tammy UPS Package Delivery Drivers can build remarkable bonds with the communities they serve. This is the story of 6-year-old Parson and her favorite UPS Driver, Miss Tammy. Watch Video (Video, Opens in Popup)

-

-

-

Tractor Trailer Drivers | Careers at UPS Learn about a typical day-in-the-life of a UPS Tractor Trailer and Sleeper Driver. Discover more information on benefits, perks, and qualifications for the role here.

Tractor Trailer Drivers | Careers at UPS Learn about a typical day-in-the-life of a UPS Tractor Trailer and Sleeper Driver. Discover more information on benefits, perks, and qualifications for the role here. -

UNITED PARCEL SERVICE Career Path Program Promoting from within and helping UPSers build meaningful and rewarding careers is important to UPS.

UNITED PARCEL SERVICE Career Path Program Promoting from within and helping UPSers build meaningful and rewarding careers is important to UPS. -

Hourly, Part Time, Full Time and Seasonal Jobs Our hourly and seasonal employees are critical and essential. Learn more and discover hourly, part-time, full-time and seasonal jobs at UPS here.

Hourly, Part Time, Full Time and Seasonal Jobs Our hourly and seasonal employees are critical and essential. Learn more and discover hourly, part-time, full-time and seasonal jobs at UPS here. -

Military and Veteran Job Opportunities and Careers | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran Job Opportunities and Careers | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

Military and Veteran Culture | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran Culture | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

Military and Veteran Resources | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran Resources | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

Military and Veteran History | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service.

Military and Veteran History | Careers at UPS You’ve served your country honorably. Now you’re ready for your next challenge. Join UPS and you’ll join a company that values your military service. -

-

-

Explore UPS Want to learn even more about UPS? Check out these additional stories about our people, mission, values and global impact.

Explore UPS Want to learn even more about UPS? Check out these additional stories about our people, mission, values and global impact. -

-

-

In Safe Hands With the help of UPSers like Assistant Chief Pilot, Alyse Adkins, we were able to ship vaccines to more than 110 countries with a 99.9% on-time delivery rate.

In Safe Hands With the help of UPSers like Assistant Chief Pilot, Alyse Adkins, we were able to ship vaccines to more than 110 countries with a 99.9% on-time delivery rate. -

-

Christian G. "I think the main thing that separates UPS from other companies and internships is that everyone who works there—is for everyone else." Hear more from our Industrial Engineering Intern.

Christian G. "I think the main thing that separates UPS from other companies and internships is that everyone who works there—is for everyone else." Hear more from our Industrial Engineering Intern. -

Benefits for Team UPS We wouldn't be the company we are without our dedicated UPSers—which is why we offer great benefits to support their physical, financial, and emotional wellbeing.

Benefits for Team UPS We wouldn't be the company we are without our dedicated UPSers—which is why we offer great benefits to support their physical, financial, and emotional wellbeing. -

Donovan N. "Without Metro College, my life would be 10 times harder. It's a great and rewarding thing when you graduate. I would do it all over again like I just did." Hear from our Procurement Coordinator.

Donovan N. "Without Metro College, my life would be 10 times harder. It's a great and rewarding thing when you graduate. I would do it all over again like I just did." Hear from our Procurement Coordinator. -

Alexandra O. "Je suis à ma place ici. J’ai un but ici." Écoutez davantage notre superviseure sur route et découvrez son parcours ici chez UPS.

Alexandra O. "Je suis à ma place ici. J’ai un but ici." Écoutez davantage notre superviseure sur route et découvrez son parcours ici chez UPS. -

Anette B. "At UPS, I feel included because we are involved in decision making as a team and our opinions matter." Hear more from our Billing Coordinator.

Anette B. "At UPS, I feel included because we are involved in decision making as a team and our opinions matter." Hear more from our Billing Coordinator. -

Anlly M. "I'm proud to know that we connect the world and that, here, we can be who we are. Even with a dress code, we can express ourselves." Hear more from our Accounts Payable Supervisor.

Anlly M. "I'm proud to know that we connect the world and that, here, we can be who we are. Even with a dress code, we can express ourselves." Hear more from our Accounts Payable Supervisor. -

-

-

-

-

-

-

-

-

-

-

Anlly M. "Estoy orgullosa de saber que conectamos el mundo y que, aquí, podemos ser quienes somos. Incluso con un código de vestimenta, podemos expresarnos." Hear more from our Accounts Payable Supervisor.

Anlly M. "Estoy orgullosa de saber que conectamos el mundo y que, aquí, podemos ser quienes somos. Incluso con un código de vestimenta, podemos expresarnos." Hear more from our Accounts Payable Supervisor. -

Anthony V. "I’ve learned a lot about military culture and how veterans transition to the workplace, which is something I would have never known." Hear more from our Human Resources Intern.

Anthony V. "I’ve learned a lot about military culture and how veterans transition to the workplace, which is something I would have never known." Hear more from our Human Resources Intern. -

Arnold S. "Here, I feel comfortable in my own skin." Hear more from our Customer Service team member, Arnold, about his experience working in our welcoming culture.

Arnold S. "Here, I feel comfortable in my own skin." Hear more from our Customer Service team member, Arnold, about his experience working in our welcoming culture. -

Carina C "I like that our growth can be lateral or vertical—it's our call. I get to decide how I want to grow and what I want to experience." Hear more from our Operations Excellence Staff Manager.

Carina C "I like that our growth can be lateral or vertical—it's our call. I get to decide how I want to grow and what I want to experience." Hear more from our Operations Excellence Staff Manager. -

Learn About Metropolitan College Interested in growing your education with the help of UPS? Start here—with all the information you need to know about the Metropolitan College Education Program.

Learn About Metropolitan College Interested in growing your education with the help of UPS? Start here—with all the information you need to know about the Metropolitan College Education Program. -

-

-

-

-

-

Discover UPS Airline Our air fleet is fully equipped to deliver what matters across the world. On this team, you’ll get to see firsthand the logistics that support UPS Air Cargo and make our global operations possible.

Discover UPS Airline Our air fleet is fully equipped to deliver what matters across the world. On this team, you’ll get to see firsthand the logistics that support UPS Air Cargo and make our global operations possible. -

Shawna B. "Metro College gives students a leg up because they already have an employer who is investing in them." Here from a Metropolitan College Alum.

Shawna B. "Metro College gives students a leg up because they already have an employer who is investing in them." Here from a Metropolitan College Alum. -

Discover UPS Engineering There’s a UPS team for most engineering specialties—including electrical, civil, and mechanical. You’ll get to work on key projects like automation, facility maintenance, conveyor design, and more!

Discover UPS Engineering There’s a UPS team for most engineering specialties—including electrical, civil, and mechanical. You’ll get to work on key projects like automation, facility maintenance, conveyor design, and more! -

Explore Our Sales Team Are you a problem-solver and passionate communicator? On the sales team, you can bring our services to life, identifying areas of supply chain improvement and available solutions for our customers.

Explore Our Sales Team Are you a problem-solver and passionate communicator? On the sales team, you can bring our services to life, identifying areas of supply chain improvement and available solutions for our customers. -

Bavitha B. "I would recommend the UPS summer internship program to my peers because the people I worked with made my time here very enjoyable—they were capable, motivated, and effective team players."

Bavitha B. "I would recommend the UPS summer internship program to my peers because the people I worked with made my time here very enjoyable—they were capable, motivated, and effective team players." -

Nicole G. "I had such a good experience with my supervisor and manager… never would I have thought I could learn so much in such a small timeframe." Hear from our Information Technology Intern.

Nicole G. "I had such a good experience with my supervisor and manager… never would I have thought I could learn so much in such a small timeframe." Hear from our Information Technology Intern. -

Akiva P. "We go above and beyond for our customers and provide a stellar service." Hear from our Customer Resolution Agent.

Akiva P. "We go above and beyond for our customers and provide a stellar service." Hear from our Customer Resolution Agent. -

-

-

Leah L. "I feel good when I am contributing towards something useful and positive. I feel like I am doing something great here. I love how I really am helping this company."

Leah L. "I feel good when I am contributing towards something useful and positive. I feel like I am doing something great here. I love how I really am helping this company." -

Jordan M. "Less than a year after I graduated, I bought a house on my own because of all the benefits that I received, and the freedom that I had from graduating debt free." Hear from a Metro College Alum.

Jordan M. "Less than a year after I graduated, I bought a house on my own because of all the benefits that I received, and the freedom that I had from graduating debt free." Hear from a Metro College Alum. -

Katy K. "I hope I can be a testimony to show that you can have a balance between work, school, and whatever social events or clubs you want to be a part of." Hear from a Metro College Alum.

Katy K. "I hope I can be a testimony to show that you can have a balance between work, school, and whatever social events or clubs you want to be a part of." Hear from a Metro College Alum. -

THE UPS GOLDEN RULES We all have the responsibility to promote a positive, professional work environment – for everyone. Not in Our House means we do not tolerate inappropriate behavior.

THE UPS GOLDEN RULES We all have the responsibility to promote a positive, professional work environment – for everyone. Not in Our House means we do not tolerate inappropriate behavior. -

Learn about a typical day-in-the-life of a UPS Warehouse Worker here. Review the answers to common questions about our Personal Vehicle Drivers here.

Learn about a typical day-in-the-life of a UPS Warehouse Worker here. Review the answers to common questions about our Personal Vehicle Drivers here. -

-

-

-

-

-

-

Transitional Learning Center FAQ Get all your questions answered about the UPS Transitional Learning Center program here.

Transitional Learning Center FAQ Get all your questions answered about the UPS Transitional Learning Center program here. -

School to Work FAQ Still have questions about the details of our School to Work program? You can find answers and additional information about this opportunity here.

School to Work FAQ Still have questions about the details of our School to Work program? You can find answers and additional information about this opportunity here. -

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program.

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program. -

Earn & Learn FAQ Curious about our Earn & Learn program? If you have questions, be sure to check out our FAQ page for additional information about this great UPS education option.

Earn & Learn FAQ Curious about our Earn & Learn program? If you have questions, be sure to check out our FAQ page for additional information about this great UPS education option. -

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program.

Metropolitan College FAQ Credit hours? Subject majors? Housing? Here's where you can get detailed answers to some of the most common questions we see for the Metro College Program. -

-

-

-

Charlotte, NC Interested in checking out all of the Warehouse Worker opportunities available in this lively southern city?

Charlotte, NC Interested in checking out all of the Warehouse Worker opportunities available in this lively southern city? -

Life-saving drones This is the story of how UPS shipped blood, medicine and vaccines to facilities across Rwanda using a fleet of drones.

Life-saving drones This is the story of how UPS shipped blood, medicine and vaccines to facilities across Rwanda using a fleet of drones. -

Giving back to those who gave so much UPS is a long-time supporter of veterans. This is just one story of how our employees have gotten involved with initiatives that give back to those who’ve given so much to our country.

Giving back to those who gave so much UPS is a long-time supporter of veterans. This is just one story of how our employees have gotten involved with initiatives that give back to those who’ve given so much to our country. -

FlightPath I Interested in flying with UPS? Check out this immersive program where you can take your first steps. Available to recent grads and current juniors or seniors!

FlightPath I Interested in flying with UPS? Check out this immersive program where you can take your first steps. Available to recent grads and current juniors or seniors! -

FlightPath II This 36-month program helps you achieve the required benchmarks needed to interview with UPS Airlines. You'll develop skills, build experience, and receive expert mentoring.

FlightPath II This 36-month program helps you achieve the required benchmarks needed to interview with UPS Airlines. You'll develop skills, build experience, and receive expert mentoring. -

FlightPath Overview Ready to take your career to new heights? Become a pilot with UPS. You'll fly with one of the world’s largest and safest airlines while helping move the world forward by delivering what matters.

FlightPath Overview Ready to take your career to new heights? Become a pilot with UPS. You'll fly with one of the world’s largest and safest airlines while helping move the world forward by delivering what matters. -

Puestos por hora Ayudarás a entregar lo que importa. Ofrecemos puestos por hora de tiempo completo, medio tiempo, durante todo el año y por temporada.

Puestos por hora Ayudarás a entregar lo que importa. Ofrecemos puestos por hora de tiempo completo, medio tiempo, durante todo el año y por temporada. -

Erin M. "L’avis de tous est important; c’est pourquoi nous avons une politique de la porte ouverte. Si vous avez des idées et que vous souhaitez en parler, n’hésitez pas!"

Erin M. "L’avis de tous est important; c’est pourquoi nous avons une politique de la porte ouverte. Si vous avez des idées et que vous souhaitez en parler, n’hésitez pas!" -

Evan B. "Never stop asking questions, because that’s really how you’ll learn." Hear about our Engineering Intern and his educational experience here at UPS.

Evan B. "Never stop asking questions, because that’s really how you’ll learn." Hear about our Engineering Intern and his educational experience here at UPS. -

Spring Y. "My well-being is a priority here and not an afterthought." Hear more from our Operations Supervisor of Contracts Logistics.

Spring Y. "My well-being is a priority here and not an afterthought." Hear more from our Operations Supervisor of Contracts Logistics. -

Sydnee A. "At the end of the day I love knowing that people have been with UPS for a long time and they rise and grow." Hear more from our Human Resources Intern.

Sydnee A. "At the end of the day I love knowing that people have been with UPS for a long time and they rise and grow." Hear more from our Human Resources Intern. -

Bayonne, NJ See what's happening at our New Jersey facility and join our team of Warehouse Workers to help us deliver what matters.

Bayonne, NJ See what's happening at our New Jersey facility and join our team of Warehouse Workers to help us deliver what matters. -

Atlanta, GA Curious to see what UPS operations are like in Georgia's capital city? Check out opportunities at our Atlanta hub.

Atlanta, GA Curious to see what UPS operations are like in Georgia's capital city? Check out opportunities at our Atlanta hub. -

Greenville, SC This pedestrian-friendly city is home to art, outdoor, and—of course—our UPS warehouse. Apply today to join our team here.

Greenville, SC This pedestrian-friendly city is home to art, outdoor, and—of course—our UPS warehouse. Apply today to join our team here. -

San Antonio, TX Find opportunities at UPS warehouse facilities here in Texas—where you'll also be able to enjoy a rich, vibrant culture.

San Antonio, TX Find opportunities at UPS warehouse facilities here in Texas—where you'll also be able to enjoy a rich, vibrant culture. -

DFW, TX Become part of Team UPS here in Dallas-Fort Worth, Texas! We're now hiring for Warehouse Worker roles.

DFW, TX Become part of Team UPS here in Dallas-Fort Worth, Texas! We're now hiring for Warehouse Worker roles. -

Mebane, NC Our warehouse workers thrive in a fast-paced environment—even during night shifts! Apply to join Team UPS today.

Mebane, NC Our warehouse workers thrive in a fast-paced environment—even during night shifts! Apply to join Team UPS today. -

UPS SMART Hub Discover opportunities to join UPS at this impressive facility in Atlanta, Georgia. With advancement and automation throughout the SMART hub, you’ll get to see our industry-leading technology at work.

UPS SMART Hub Discover opportunities to join UPS at this impressive facility in Atlanta, Georgia. With advancement and automation throughout the SMART hub, you’ll get to see our industry-leading technology at work. -

Los Angeles, CA Ready to start a career with UPS in sunny LA? Check out what it takes to become a Warehouse Worker in our hub.

Los Angeles, CA Ready to start a career with UPS in sunny LA? Check out what it takes to become a Warehouse Worker in our hub. -

Madison, WI We're now hiring in the Madison area! Check out available opportunities near this ideally located city.

Madison, WI We're now hiring in the Madison area! Check out available opportunities near this ideally located city. -

Nashville, TN Discover new opportunities near Music City! We're now hiring Warehouse Workers at our nearby hub.

Nashville, TN Discover new opportunities near Music City! We're now hiring Warehouse Workers at our nearby hub. -

New York, NY Discover our UPS operations in the greater New York area. We're now hiring for Warehouse Workers in various shifts!

New York, NY Discover our UPS operations in the greater New York area. We're now hiring for Warehouse Workers in various shifts! -

Middletown, PA This impressive new facility is now up and running in Pennsylvania! We're hiring new team members to support operations.

Middletown, PA This impressive new facility is now up and running in Pennsylvania! We're hiring new team members to support operations. -

Naples, FL Join us in Naples, FL today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits.

Naples, FL Join us in Naples, FL today to begin a rewarding career as a Warehouse Worker - Package Handler. Read on to discover more about the work, location and benefits. -

Portland, OR Ready to join Team UPS? Discover new opportunities at our warehouse located in Oregon's largest city.

Portland, OR Ready to join Team UPS? Discover new opportunities at our warehouse located in Oregon's largest city. -

Shelly C. "From day one, I loved the open-door culture and it’s still great more than 10 years later." Hear more from our Marketing Pricing Manager.

Shelly C. "From day one, I loved the open-door culture and it’s still great more than 10 years later." Hear more from our Marketing Pricing Manager. -

Sherry S. "My career here, 20 years and counting, is a story of progress and moving forward." Hear more form our International Director of Freight.

Sherry S. "My career here, 20 years and counting, is a story of progress and moving forward." Hear more form our International Director of Freight. -

Zane P. "The trust that my team has in me speaks volumes about the company. It gives me the chance to show my abilities and come up with something great." Hear more from our DE&I Intern.

Zane P. "The trust that my team has in me speaks volumes about the company. It gives me the chance to show my abilities and come up with something great." Hear more from our DE&I Intern. -

Reginaldo T. "Entregar o que importa é o que me faz feliz. Trazer a vacina da COVID para o Brasil me deixou muito orgulhoso, saber que participei deste momento confirma que entregamos o que importa."

Reginaldo T. "Entregar o que importa é o que me faz feliz. Trazer a vacina da COVID para o Brasil me deixou muito orgulhoso, saber que participei deste momento confirma que entregamos o que importa." -

Savannah V. "This program has given me so many opportunities to figure out exactly what I want to do and find myself." Hear from a Metropolitan College Alum.